Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, we look at increasing postal rates and provide an update on real estate values, in 2024. (See the Tangibles Investing section.)

Precious Metals:

Gold and silver have held fairly high prices thusfar in 2024. JWR’s Comments: When I last checked, spot gold was at 2,062.00 USD per Troy ounce, and silver was at $23.41 per ounce. As always, buy on the dips, or Dollar Cost Average your precious metals purchases. As a prepper, I must always emphasize: Avoid “paper” metals such as mining stock shares and ETFs. Instead, buy physical metals, take delivery and store them very well hidden, at home. (But let at least two other trusted family members know their exact location – just in case you die unexpectedly.) When buying, search for a trustworthy dealer that charges low premiums. Pay cash, to avoid a paper trail. Be willing to drive a long distance for cash deals when buying precious metals, to maintain your privacy.

o o o

Phil Carr: How High Will Gold Prices Go In 2024?

Economy & Finance:

Entry-Level Jobs Pay Six Figures In This Gritty Part Of America.

o o o

BlackRock Announces Plans To Lay Off Over 600 Employees.

o o o

Banks should increase use of ‘discount window’ to prevent crises – expert group.

o o o

FINRA Publishes 2024 Regulatory Oversight Report.

Commodities:

o o o

ING: Watch: Our top calls for metals in 2024.

o o o

A recent Tucker Carlson interview with a rational scientist, Dr. Willie Soon: The truth about “fossil” fuels and climate change. (49 minutes, well spent.)

Derivatives:

o o o

2024 will be the year crypto investors get sophisticated with derivatives.

o o o

How Swiss authorities bungled Credit Suisse oversight.

o o o

Updated: OTC Derivatives Compliance Calendar.

Forex & Cryptos:

Yen Plunges After Japan Wage-Growth Collapses, Crushing Hope For BOJ Hikes.

o o o

At Currency Thoughts: Muted Initial Reaction to U.S. December CPI Data.

o o o

Just as I warned folks: Democrats Dissent On SEC Spot Bitcoin Approval, Gensler Distances Himself From ‘Terrorist-Financing’ Crypto.

o o o

Bitcoin ETFs begin trading on Cboe, NYSE Arca and Nasdaq.

Tangibles Investing:

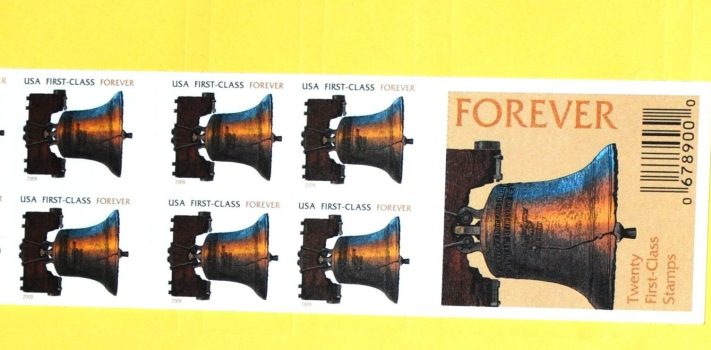

Chris at ForeverStampPrice.com wrote, with this update:

“Postage rates are increasing once more. Since July of 2022 postage rate increases have occurred every six months, and have gone up 13% over the past 1.5 years.

The upcoming increase is only a 3% increase, as the rate [for Forever Stamps] will be increasing from $.66 to $.68 on January 21, 2024.

Readers should evaluate if they need any, prior to an increase. If you need stamps, now is the time to check your supply, and order.

-

- One Ounce Forever Stamps: increases from $0.66 to $0.68 (3% increase)

- Additional Ounce Forever Stamp: remains the same at $0.24

- Two Ounce Forever Stamp: increases from $0.90 to $0.92 (2% increase)

- Three Ounce Forever Stamp: increases from $1.14 to $1.16 (2% increase)

- Postcard Forever Stamp: increases from $0.51 to $0.53 (4% increase)

- Global Forever Stamp: increases from $1.50 to $1.55 (3.5% increase)

Always be sure to purchase genuine stamps as there are many discount-price counterfeits circulating online.”

You can sign up for his e-mail alerts about future stamp price increases at: https://foreverstampprice.com

o o o

Man finds 600 of the rarest, century-old baseball cards in late father’s closet.

o o o

Will the Housing Market Crash in 2024?

o o o

The Commercial Real Estate Outlook for 2024.

o o o

o o o

Farm Progress reports: Farmland values expected to decline in ’24, ‘25.

o o o

From the leftist/statist S.F. Chronicle: Private timberland from Washington to California lost billions in value due to wildfires. JWR’s Comments: They of course attribute the larger number extensive forest fires to “climate change” rather than poor forest management practices by state and Federal government agencies…

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. Thanks!