Opportunity Knocks: Building and Registering Tax-Free Suppressors – Part 1

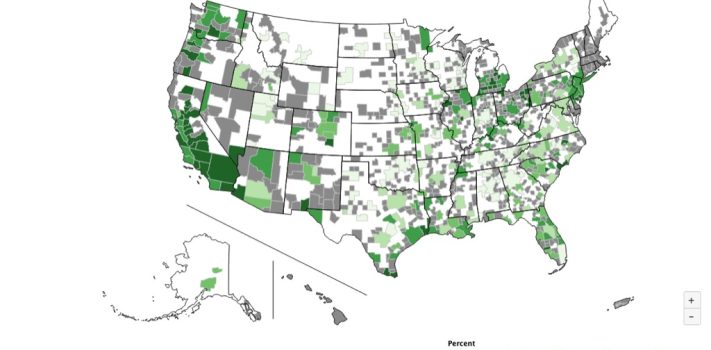

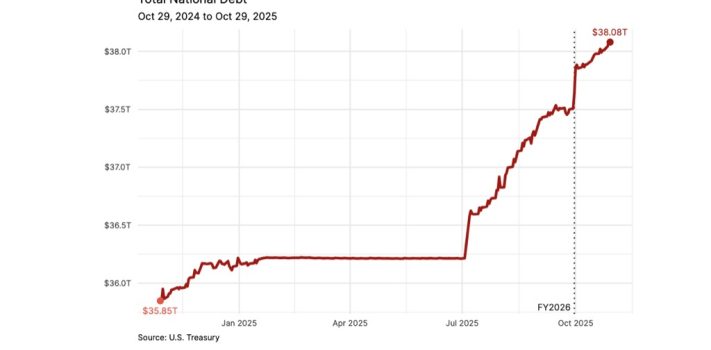

Introductory Legal Proviso: What I’m presenting in this article is solely for informational purposes. Consult local, state, and Federal law before buying or constructing a suppressor. Stay legal! Take note that the following applies only to folks who live in free states. There are many states like California and Illinois that have bans on suppressors. – JWR — As of January 1, 2026, the National Firearms Act (NFA) Tax on suppressors (called “silencers” in the legal world), short-barreled rifles (SBRs), and short-barreled shotguns (SBSes) will drop from $200 per transfer to ZERO. So now, although the NFA transfer application no …