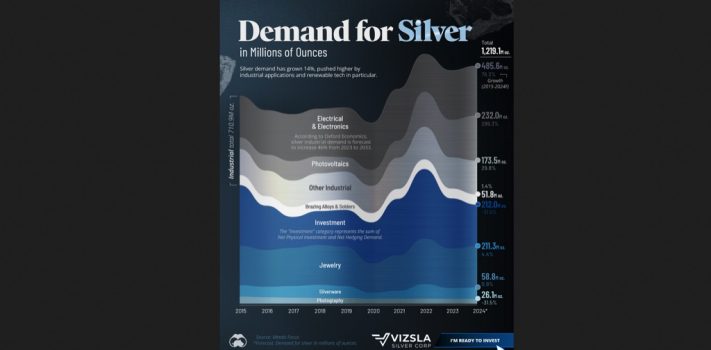

In Economics & Investing Media of the Week we feature photos, charts, graphs, maps, video links, and news items of interest to preppers. This week, a chart showing the growth of global silver demand, and its components. It was published 11 months ago. Demand is now even higher. The annual production deficit also keeps growing.

The thumbnail below is click-expandable.

(Graphic courtesy of Visual Capitalist and Vizsla Silver Corp.)

Economics & Investing Links of Interest

- At The Burning Platform: Samsung Just Dropped A “Silver Bomb” . . . Their New “Solid State” Battery Tech Breaks Global Silver Supply

- I’ve noticed that the price of slabbed Morgan U.S. silver dollars has not kept up with the rapidly rising spot price of silver. So, at present, you can find PCGS and NGC common-date slabbed Morgans in the range of AU 50 to MS 60 grade for just a hair over spot! (A U.S. silver dollar has 0.7734 Troy ounce of silver. At a spot silver price of $67.11 per ounce, that equates to a melt (bullion) value of $51.90.) And with so many Chinese fake Morgans now flooding the market, it is worthwhile to pay a bit more than melt to buy slabbed coins, as proof of authenticity. So, if you can find PCGS or NGC slabbed AU50 to MS60 grade non-1921 and non-cleaned Morgans for under $53 each, then jump on them! – JWR

- An APMEX podcast: America Took Everyone’s Gold Once. Could it Happen Again?

- $40B FED Buying Spree Kicks Off QE’s Return.

Economics & Investing Media Tips:

Please send your economics and investing links to JWR. (Either via e-mail or via our Contact form.) Thanks!