Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. In this column, JWR also covers hedges, derivatives, and various obscura. This column emphasizes JWR’s “tangibles heavy” investing strategy and contrarian perspective. Today, another sobering look at the National Debt. (See the National Debt and Deficit section.) Oh, before you jump to the conclusion that I picked an “old” photo of the National Debt Clock… It is only about four years old. That is how rapidly the National Debt has blossomed.

Precious Metals:

Largest gold deposit in the world worth $83 billion found in China.

o o o

Gold-Backed Or Bust: Judy Shelton’s Plan To Tame The Fed And Restore The Dollar.

o o o

Florida Authorities Recover 37 Gold Coins Stolen From 1715 Fleet Shipwrecks.

Economy & Finance:

US consumer price increases accelerated last month with inflation pressures resilient.

o o o

California Private Sector Employment Has Collapsed.

o o o

Reader E.S. sent this: 2025 Could Be Horrendous for Car Sales. It’s a Huge Test for EVs.

Commodities:

Several readers mentioned this news: Coffee Gets Even Pricier as Arabica Jumps to Highest Since 1977.

o o o

Oil field under Falkland Islands even bigger than first thought.

o o o

Cargill to lay off thousands of workers amid falling commodity prices.

o o o

China Announces a Ban on Rare Minerals to the U.S..

National Debt and Deficit

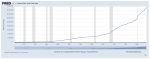

This Federal Reserve chart depicting the current Total Public Debt clearly shows the national dilemma. The shaded gray bars indicate recession periods. Given the nature of compounding interest, this dilemma is impossible to resolve without either massive debt repudiation or Weimar-scale mass inflation. In short, the U.S. Dollar is doomed. I must repeat my long-standing advice: Diversify out of U.S. Dollar-denominated investments. Your only real safety will be in personally-held physical precious metals and other tangible investments. Owning productive farmland or ranchland that doubles as a functional, well-stocked retreat should be your premier goal! – JWR

This Federal Reserve chart depicting the current Total Public Debt clearly shows the national dilemma. The shaded gray bars indicate recession periods. Given the nature of compounding interest, this dilemma is impossible to resolve without either massive debt repudiation or Weimar-scale mass inflation. In short, the U.S. Dollar is doomed. I must repeat my long-standing advice: Diversify out of U.S. Dollar-denominated investments. Your only real safety will be in personally-held physical precious metals and other tangible investments. Owning productive farmland or ranchland that doubles as a functional, well-stocked retreat should be your premier goal! – JWR

o o o

Bipartisan site: Deficit Tracker.

o o o

Public debt of the United States from October 2013 to October 2024.

o o o

Posted in October: Exploding Interest on the National Debt.

o o o

Policy Basics: Deficits, Debt, and Interest.

Forex & Cryptos:

Reader D.R. spotted this news: South Korean won falls sharply against the U.S. dollar after president declares martial law.

o o o

From Reader H.L.: Brazil: Currency Suffers Record-Breaking Crash over Socialists’ Fiscal Policy Battle. JWR’s Comment: To paraphrase Robert Downey, Jr., as Kirk Lazarus: “Everybody knows you never go Full Maduro.”

o o o

Elon Musk Predicts Financial Crisis in the U.S., Proposes Dogecoin as a Solution.

o o o

Bitcoin Is Surging, and the IRS Is Watching Closer Than Ever.

Tangibles Investing:

A dozen eggs and a dozen bullets: Ammunition hits US grocery stores.

o o o

Palmetto State Armory (one of our affiliate advertisers) started their annual “AR-15 Days of Christmas” specials, this week. Take a look!

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. Thanks!