Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. Most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at farmland investing, as a hedge on inflation. (See the Tangibles Investing section.)

Precious Metals:

David W. suggested this: What You Need To Know About Physical Gold Supply And Demand.

o o o

How The West’s Ban On Russian Gold Could Backfire.

o o o

Bank of Russia will buy gold from banks at a fixed price from March 28. JWR’s Comments: That quoted rate per gram sounds ridiculous. Was that a mistranslation? Or did someone shift a decimal point? Perhaps this is just their first step in the process of pegging the Russian Ruble to gold.

Economy & Finance:

Key part of yield curve inverts, blaring recession warning. JWR’s Comments: Don’t ignore this, folks. If you haven’t done so already, shift your portfolios to recession-proof positions!

o o o

Mortgage rate soars closer to 5% in its second huge jump this week.

o o o

Warning: Trading houses set for collapse as ‘margin call doom loop’ is about to go global.

o o o

The Big Bond Blowup: Worst Bust Since Marshall Plan.

o o o

57% of U.S. households paid no federal income tax last year as Covid took a toll, study says.

Commodities:

Nickel king short sells with losses. Buried in this article was this zinger:

“The LME said it would start a process to try to close out short positions by matching market participants with long and short positions before the market reopened, to reduce the risk that this week’s squeeze is repeated when trading resumes.

About 50,000 tonnes of Xiang’s total nickel short position of over 150,000 tonnes is held through an over-the-counter position with JP Morgan, which means Tsingshan owed the bank about US$1 billion in margin, sources said.”

JWR’s Comments: That makes JP Morgan the hedge-holding counterparty, to the tune of $1 billion USD. (Read: “On the hook.”) Remember what I’ve written before, about OTC derivatives counterparty risk, when there are large market swings?

o o o

Speaking of nickel, when I last checked, the spot price of nickel was around $33,100 per ton. That is about twice what it sold for, a year ago. Oh, and today’s melt value of a Nickel 5-cent-piece is just over 8 cents.

o o o

Soaring Cotton Prices Could Mean Clothing Is About To Get More Expensive.

Derivatives:

FASB issues expanded hedge accounting standard.

o o o

Triennial OTC Derivatives Market Share: Industry Segment by Applications.

Forex & Cryptos:

GBP/USD Forex Signal: Pound Sells Off After Bailey’s Warning.

o o o

Forex Weekly Forecasts – March 28th, 2022.

o o o

US Lawmakers Introduce ‘ECASH’ Bill in New Push to Create a Digital Dollar.

o o o

Liquidations Continue To Rock The Market As Bitcoin Breaks $47,000.

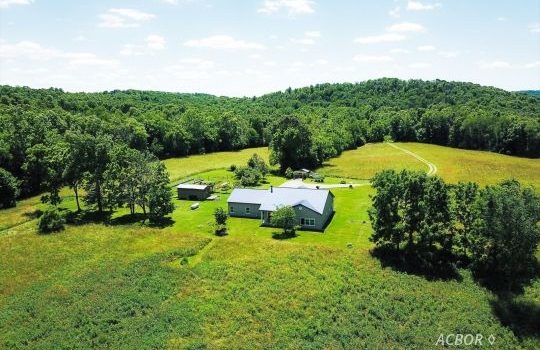

Tangibles Investing:

Sean B. spotted this: Water availability, regs spur farmland value chasm. Sean’s Comment: This article points out that agricultural land without water is just “land”. The article also has good information on agricultural land values in California.

o o o

An updated guide: The State of Agricultural Investing 2022. From the introduction:

“Investors may not fully appreciate a diversified portfolio until they come face to face with long bouts of uncertainty. This was a key theme for most of 2021, as skyrocketing inflation and shifts in consumer buying habits upset the balance of risk vs. reward for many traditional investment assets. However, one asset that continued to perform well and even served as a hedge against inflation was farmland.

While most assets perform poorly during times of inflation, farmland has historically not been correlated with the performance of traditional assets. In fact, farmland has produced double-digit returns throughout the last 40 years, far outpacing inflation. And since farmland isn’t a cash asset, its value will continue to grow even if the value of the dollar declines.”

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail or via our Contact form.) These are often especially relevant because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News items from local news outlets that are missed by the news wire services are especially appreciated. And it need not be only about commodities and precious metals. Thanks!