Here are the latest news items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of SurvivalBlog’s Founder and Senior Editor, JWR. Today, we look at investing in rare vinyl record albums. (See the Tangibles Investing section.)

Precious Metals:

Over at Zero Hedge: The Golden Asteroid Worth $700 Quintillion

o o o

Back Up The Truck And Stack Silver Says Rich Dad’s Robert Kiyosaki

Economy & Finance:

Wolf Richter: And the US Dollar’s Status as Global Reserve Currency?

o o o

World Bank: Global Growth to Weaken to 2.6% in 2019, Substantial Risks Seen

o o o

Make America’s deficits great again

Commodities:

The continuing wet weather in the Midwest greatly delayed planting of corn. So harvests this year will probably be meager. Even cover crops will be harvested this year, just to supply enough feed for livestock. High corn prices will push up the prices of some other grains and of hay. I suggest that you top off your stored grain now, while prices are still low.

o o o

U.S. Oil Output Tops 12 Million Barrels a Day for First Time.

Barter & Counter-Trade:

Reader H.L. sent us this: How Pepsi Once Became The World’s 6th Largest Military

o o o

An article from 2016: With focus on transparency, barter agencies get more scrutiny

o o o

36 Bartering & Swapping Websites – Best Places to Trade Stuff Online

o o o

No money, only food bartering at southern Nigerian market

Cryptos:

I recently had conversation with one of my consulting clients, who brought up the topic of Bitcoin. I related this advice: Yes, started recommending Bitcoin again, a few months back, as speculative a hedge. But I still have strong reservations about putting more than just a very small part of your net worth into Bitcoin or other cryptocurrencies. Yes, Bitcoin does have the potential to double, triple, or even quadruple in the next year or two. (As of Wednesday July 10, 2019 it took nearly $13,000 to buy 1 BTC.) But there is also the possibility of BTC crashing back down to less than $4,000 USD. Don’t risk getting burned by investing in it heavily. Several times in the book of Proverbs, we are warned against unjust weighs and measures. In essence, cryptocurrencies have no substance to them. So they are the ultimate in “unbacked” currencies and they typify mania speculation. At least those who bought Dutch tulip bulbs got something tangible, in exchange for their Guilders. Peter Schiff says it best: Buying Bitcoin is like buying air.

Tangibles Investing:

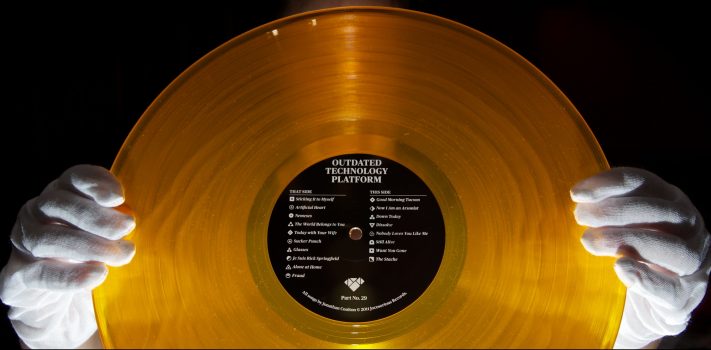

In the audiophile world, there is niche market in rare vinyl record albums. These are not your quotidian mass-produced stereo LP records. The following are links that I’ve found to articles with some details for folks who are “pickers”. These are the really rare albums. Many of them were limited edition records from the 1960s to 1990s. A few are 78 RPM albums that date back to the 1930s, and a few others are 45 RPM singles. But most of them are 33 RPM stereo albums:

o o o

10 Records You Might Have Owned That Are Now Worth a Fortune

o o o

11 Rare Vinyl Records We Bet You Don’t Own

o o o

The most valuable vinyl records on Earth, from The Beatles to The Sex Pistols

o o o

The 20 Most Valuable Records Ever

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. Please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who closely watch specific markets. If you spot any news that would be of interest to SurvivalBlog readers, then please send it in. News from local news outlets that is missed by the news wire services is especially appreciated. And it need not be just about commodities and precious metals. Thanks!

IMAO: I suggest taking the predictions of a recession this year — maybe even next year — with a grain of salt. It could happen, of course, but the world’s central banks are lining up to push interest rates to negative (not a typo) levels. (BTW this will be very positive for precious metals and collectibles.} The economy will respond, things will look good for a while. The stock market will probably go up — maybe considerably higher than it is now. Thus, there’s money to be made, but dance close to the exits folks. I’ve mentioned using out of the market trailing stops before, but they’re even more important now.

One more point. If/when the crisis does start, banks will start to fail. Under the Dodd Frank law, banks can take (steal) part of their(your) deposits to keep themselves solvent. The government won’t bail them out the next time — we will. It’s called a bail-in.

There’s not too much you can do about this — we need banks, after all — but credit unions may be safer due to their not investing in derivative securities and the like. If you’re a veteran, you can use Navy Federal Credit Union (all military branches qualify), the largest credit union in the country. (I have no connection with them, other than as a depositor.)

I predict a recession sometime between now and 2030. Essentially when everything goes south is somewhat unpredictable IMO although Doc Strange’s comments are quite reasonable.

The only thing I would offer is that in my adult life, we have never went more than about 10 years give or take without a recession. The efforts to hold them off seem more extreme every time however.

“The government won’t bail them out the next time — we will. It’s called a bail-in.”

What’s old is new again. I remember when banks were backed by deposits and well run banks loaned no more than they had to loan. The old ways really are better. Fractional reserve banking is what they call it now, banks can loan X percent above deposits. Silly, money based on debt, or thin air.

Re. Make America’s deficits great again

Trump is just another Republican bought and paid for by Big Corporate.

He gives Big Corporate tax breaks which instead of passing onto Little People they use it buy back their stock and inflate their stock prices.

Trump boasts, “I am a Tariff Man….. We are right now taking in $billions in Tariffs.” Guess who pays the tariffs? Yep, we-Little People.

You are wrong, Trump is so different from other politicians.

Who pays the tariffs? These particular tariffs are being paid by China, so you are incorrect again. But far more importantly China has been screwing over America for 60 years and no president has ever tried to correct this mess. Trump is trying and using the only tools available to him. IMHO the worst possible outcome to this effort would be that China and the U.S. stop all trading and that would be a win/win for us. The most likely outcome is that Trump gets some concessions from China and not getting all he wants keeps some of the tariffs in place. That will also be good for us.

Trump will be sorely missed when he is gone.

OneGuy, let try to explain this. Trump started raising prices that the Chinese pay for Made-in-USA goods. MAGA!!!??? Whoa! Hold the champagne. The part you missed was the Chinese fought back and raised prices that Americans pay for Made-in China goods.

The Chinese were purchasing $154B from the US. Americans were purchasing $526B from the Chinese. The difference of $372B is what we call the trade deficit.

For every 1% mutual rise in costs from tariffs Americans are bled out $3.72 Billion. If you still don’t think Americans pay this ask your wife when she gets home from Walmart.

In regards to the article on American debt. There is mention of the dollar losing it’s status as a world currency. I doubt that this will happen, as bad as our debt is what nation or combination of nations has anything better to offer for a world currency?

It is likely that the end result of all this frivolous spending of fiat money that they do not have will result in the world currency becoming Food by default. We will still be the tall dog as we can raise far more food than we consume but scarcity will bring the cost to levels that the worlds population cannot afford. I ask you, what do you do when your countries population becomes hungry and you want to remain in power? History tells us that you go to war against those who have food. This thins the herd and gives the army a place to forage. Of course this scenario assumes that there is not a total collapse in which case things will get a bit weird.

Re: Debt

Couple things.

I voted for Trump and will likely do so again. But I had no thought that he or any other politician would reduce the debt. IMO no politician can currently get elected who will reduce the debt. IMO you have to reduce government spending AND eliminate tax loopholes for everyone rich and poor and corporate simultaneously. This economy is so dependant on government stimulus, legal tax evasion, cheap money that a transition to a stable situation would be extremely painful to everyone top to bottom. I am unsure whether it would even be possible at this stage without total economic collapse. However the populous both rich and poor won’t tolerate it even moderate pain if it was possible. And the actions necessary would likely take long term planning and action that would not ever be sustained.

I finally did some quick arithmetic this morning that I have meant to do for some time. My sources are quick Google searches and the specific numbers might be slightly different depending on sources but I think regardless of source the gist is the same.

In the 20 years from 1998 to 2018 US GDP increased from about $9T to $21T or about 2.3 fold. About 4.3% average over the last 20 years.

From 1998 to 2018 the US debt increased from $5.6T to about $21T or about 3.75 fold. About 6.8% average over the last 20 years.

It is the difference of 2.5% that is the issue. It is unsustainable. And it highlights the thorny problem. Raising taxes and/or cutting government spending will slow the economy (at least short term) and aggravate the situation on the GDP side even as the debt side perhaps improves. Reducing taxes and/or increasing government spending in an attempt to stimulate GDP will aggravate debt (as it is right now). And GDP growth is still stubbornly low by historical standards even with current actions to stimulate it. Raising taxes and increasing government spending will likely crash GDP (as big money flees the taxes) and will increase debt.

Cutting spending and holding fast on taxes or increasing them is the only long term action that has a hope of working IMO. (In other words Austerity measures like those imposed on Greece for instance.) But because the public and private sector are so intertwined now you will see recession (or even full blown Depression) if you do this. There is no will to travel through this difficult period without public relief which cannot come without increased spending.

2.5% differential cannot last forever. It may not even be the exact number and I make no prediction how long that number can be maintained when it is compounded yearly and the powers that be come up with more creative measures to delay the inevitable. But IMO we will go through something like bankruptcy eventually and that is when all bets are off.

I voted for Trump for at least temporary protection of the 2nd Amendment (compared to the likely alternatives) not to fix this problem. He cannot.

I view our current time like the Biblical story of the famine in Joseph’s time. Currently pretty good years. But the famine is written in the numbers.

How Pepsi Once Became The World’s 6th Largest Military

That’s pretty neat. The world really is about connections, who you know. Pepsi must have had the connections inside the Soviet Union based on prior business in order to make this transfer. Huh.

The Golden Asteroid Worth $700 Quintillion

The asteroid is worth zero. If you can’t get it then it has no value. If you get it then gold becomes mostly worthless and has no value but you sure can build a lot of circuit boards and other electrical components with it.

Bitcoin

One can literally write down the 1’s and 0’s in sequence and have a bitcoin. Bitcoin may be worth the paper and ink it’s written on, and little else. OTOH, if people believe…

I don’t see a recession before the 2020 elections. After that it’s anybody’s guess. I agree with the Austrian economists that doing the same things over and over again, and expecting a different result each time, is indeed insane. But, then again, the Keynesians and the Monetarists are insane. The sad news is that even John Maynard Keynes knew his recommended policies would only work for a very limited time and then fail BIGLY!

So my guess is sometime in 2021, the Schumer hits the fan. My guess is late spring, for no particular reason other than a barely educated guess. By then the FED should be out of ammunition to tinker with the economy. I don’t see negative interest rates in the US, the announcement alone will cause massive bank runs and a lot of dead bodies in the banks buildings. I think Jerome Powell is way too smart to even try it. THIS IS NOT EUROPE! We’re not as cowed as the Europeans and we are way better armed.

All that being said, you’ve got time, but not much. So, get your money out of the banks ASAP. Get most of your wealth transferred to hard assets. Keep two months, at least, in cash available to cover your bills and emergencies, like a a bug out. Whatever cash you do keep in the system, move it to credit unions or, if you are in someplace like Nebraska, move your money to a state bank, not governed by the FED or the FDIC. Whatever institution you choose, make sure their derivative exposure is at or near zero.

This is nothing you haven’t heard before. Then again, I could be wrong and nothing bad happens or it all happens next week. Then it would be too late for most of us, including me.

Bit coin may not be worth anything, but with the dow at 27000 the stock market has lost its connection with reality as well.