Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on Remington Firearms. (See the Tangibles Investing section, near the end of this column.)

Precious Metals:

How to Buy Gold or Silver With Bitcoin & Other Cryptos

Cryptos:

After dipping to as low as $7,421 USD last week, the value of Bitcoin seems to have bounced back. I believe that $8,000 is a realistic new floor level. There could be a test of a $6,200 USD price level, but I expect BTC to gradually build a base from around $8,100 USD. Although I hedged out of some of my Bitcoin holdings in to precious metals a while back, I’m still bullish for both BTC and Ether, in the long term.

o o o

Many libertarians were fond of asking “Who is John Galt?” Now, some have switched to asking: Who is Satoshi Nakamoto?

Economy & Finance:

o o o

There’s a new boss at China’s powerful central bank.

o o o

Irish Economy Watch (March 19 – March 23, 2018)

Tangibles Investing (Remington Firearms):

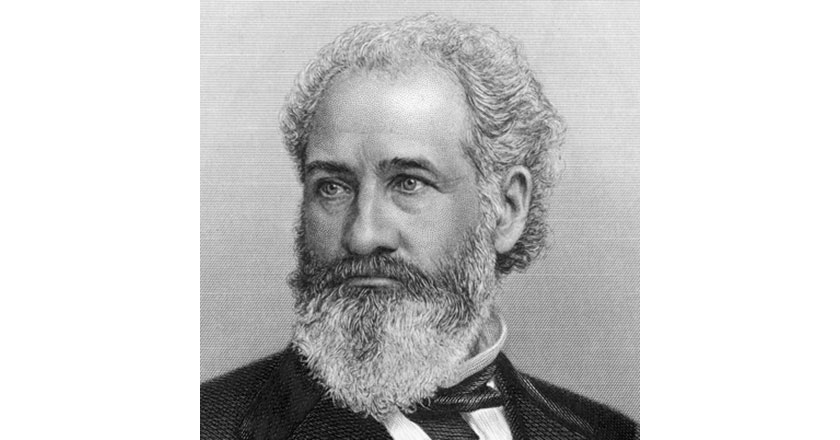

Last month’s announcement that Remington’s parent company was declaring bankruptcy came as a shock to many American shooters. Founded as a rifle barrel making firm by Eliphalet Remington Jr. in 1816, Remington has a been a titan of the American gun industry. After 212 years, it is sad to see it sinking. Some commentators cited high debt levels, mismanagement, and lack of innovation as the root cause. The bottom line: Remington Outdoor Company Inc. has called it quits, and is seeking bankruptcy protection.

It is safe to assume that many of the company’s recent acquisitions will spin back off and resume business under new names or under their original names and thus survive this mess. Most of these were, after all, quite viable companies before they were acquired by the debt-laden Remington Outdoor Company. Some of those acquisitions included LAR, Advanced Armament Corp., Montana Rifleman, Para USA (Para-Ordnance), Tapco, and DPMS/Bushmaster.

An Opportunity?

For individual collectors and investors, Remington’s bankruptcy might present an opportunity. There is of course the chance that Remington will emerge from bankruptcy and resume making guns, This is what Colt did, a few years ago. But what if there will be no more guns marked “Remington”? That would essentially freeze the pool of Remington firearms available to collectors, and prices would inevitably rise.

This leads collectors and speculators to ask: Which Remington firearms should I buy, for a potential gain? Here are some suggestions, from my perspective as a prepper:

First, consider just about any pre-World War II Remington rifle, pistol, or shotgun that is in minty condition. Bonus points for any with their original factory hang tags or factory boxes. But from a practical prepping standpoint, I recommend that you concentrate on models that are chambered in cartridges that are still fairly popular, and that are in regular factory production. Granted, an original Remington Model 8 rifle chambered in .25 Remington is a scarce gun. But unless you are a handloader, then it is probably best to skip investing in one!

Now, on to some specific choices…

Handguns:

For handguns, I’d recommend these particular Remington firearms:

- Remington-UMC M1911 pistols from WWI and Remington Rand M1911 pistols from WWII. (Yes, technically Remington Rand was a separate corporate entity at the time, but the “Remington” name always has mystique.)

- Remington Model 1911 R1 .45 ACP (recent prtocuction) pistols. The stainless steel R1 variants and the R1 Double Stack variants have been produced only in small numbers. So they might someday be particularly valuable. (The magazines for the latter are fully interchangeable with ParaOrd magazines.) The top of my list would be a Remington 1911 R1 Enhanced Stainless .45 ACP pistol. I’ve heard that less than 1,000 were produced before announcement of the bankruptcy.

- Remington XP-100 pistols chambered in .223 Remington.

Rifles:

For rifles, the list of Remington firearms is almost endless, but here are a few highlights:

- Any of the Remington R-15 and R-25 (Stoner AR family) variants. These were well-made by Remington’s wholly-owned DPMS subsidiary, but carry Remington rollmarks.

- Remington model 740/742/7400/760/7600 series rifles in popular calibers like .30-06 and .270 Winchester, and .308 Winchester.

- Remington Nylon 66 .22LR rifles in original boxes.

- The Remington 600/660/673 series “dog leg” bolt actions in .308 Winchester or .243 Winchester.

- Remington Model Seven bolt actions in .308 Winchester or .243 Winchester.

- Remington 700 series bolt actions in popular calibers like .30-06, .270 Winchester .308 Winchester or .243 Winchester. So that they can serve “double duty” as prepping rifles, stainless steel variants are preferred. Important Note: Keep in mind that there was a much publicized trigger/safety recall on the Model 700 series, so limit yourself to buying only rifles that were produced “post-recall” or that were retrofitted by the factory.

Shotguns:

- Remington 31 pump shotguns. This predecessor to the Model 870 is now scarce and collectible–if still in fine condition.

- Higher grade Model 11-87, 1100, and 870 shotguns, in their original boxes.

- Model 870 police and Marine (weatherproof) 12 gauge riotguns.

As always when buying any modern guns: Be sure to keep the original factory boxes and protect them from damage! Doing so can make a huge difference in long term resale value for most guns, as they gradually become collectible, with age.

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. So please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often “get the scoop” on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

Respectfully, No bankruptcy judge is going to require a company to forfeit it’s trademarks and patents for a debtor-in-possession financing option. However, that doesn’t mean that they might not sell the name or license or sell the patents if they end up going the liquidation route but they aren’t there yet. The later is unlikely.

Thinking this through a little more it did occur to me that, in the current hoplophobic environment they might not be able to get financing of any kind. Which could mean that, suddenly, poof! the company is gone.

But that’s why it’s called investing instead getting free money for nothing. If it was easy…

Firearms don’t actually bring much ROI compared to other types of assets except at the very high end. Inflation eats any profits for lunch. (I know, I know, fed reserve sucks.) I would think that if you like classic and antique guns then get some.

Of course, if you buy a weapon for it’s practical application and it happens to go up in value then hey, you don’t lose. And since both parties are now gun controllers I don’t see a downside…except a (non black) market to sell into… Sure, black markets net more money but you think the drug trade is violent? Wait until guns are illegal.

Random thoughts.