Here are the latest items and commentary on current economics news, market trends, stocks, investing opportunities, and the precious metals markets. We also cover hedges, derivatives, and obscura. And it bears mention that most of these items are from the “tangibles heavy” contrarian perspective of JWR. (SurvivalBlog’s Founder and Senior Editor.) Today’s focus is on investing in rare and antique motorcycles. (See the Tangibles Investing section.)

Precious Metals:

Silver keeps getting kicked into the gutter by short sellers. But the silver stackers will get their reward in the next few years. Higher interest rates will soon collapse the U.S. stock market and housing bubbles. Then we’ll see folks desperately running for safety. Those exit doors are always made visible by their gold and silver colors and their “TANGIBLE WEALTH” markings.

Cryptos:

The cryptocurrencies have certainly lived up to their reputation for high volatility since last December. When I last checked, the cost of a Bitcoin was $8,056, an Ether was $604, and a Litecoin was just $160. I suspect that we’ve reached “floor” levels. All the talk of higher interest rates appears to be driving a lot of those who bought “on margin” out of the market. This is a good time for new buyers, not sellers–especially those speculators who bought cryptos in December at the top of the market with OPM (Other People’s Money.) Buy low, and sell high. Doing it the other way around soon leads to ulcers or self-defenestration. FYI, I’m still fairly bullish on the major cryptos in the long term. But for now, “buckle up!”

Commodities:

With a Demand Floor and Shale Ceiling, Does Oil Have its House in Order?

Economy & Finance:

Will FOMC Raise Interest Rate in March 2018?

o o o

These American companies could be hurt by Trump’s tariffs. (Keep in mind that this is coming from the leftist and strongly anti-Trump CNN. )

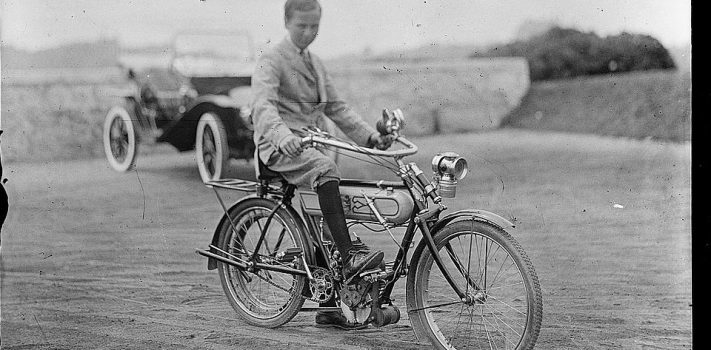

Tangibles Investing (Antique Motorcycles):

One niche in the world of collectibles investing is buying restored classic, rare, and antique motorcycles for long term appreciation. I’m not a biker, so I don’t feel qualified to make any comments on this topic. So I’ll suffice herein with a collection of articles that I found with some searches, to get you started. Note that the prices quoted in several of these articles are out-of date. For example, typical Norton Commandos are now typically selling for more than $18,000 USD:

Antique, Vintage or Classic Motorcycle?

BeMoto: Investing in Classic and Vintage Motorcycles

From The Drive, posted in 2015: 10 Killer Classic Motorcycles Under $10,000

Here is a 2013 article that provides some good reference figures (and some stunning photos): Vintage Motorcycles – Increasing Market Values

10 tips on buying at a motorcycle auction

Next, a good piece from 2007: Owning and Collecting Classic BMW Motorcycles

And I’ll round this section with an article from Forbes that dates back to 2006: Collecting Vintage Motorcycles

Provisos:

SurvivalBlog and its Editors are not paid investment counselors or advisers. So please see our Provisos page for our detailed disclaimers.

News Tips:

Please send your economics and investing news tips to JWR. (Either via e-mail of via our Contact form.) These are often especially relevant, because they come from folks who particularly watch individual markets. And due to their diligence and focus, we benefit from fresh “on target” investing news. We often “get the scoop” on economic and investing news that is probably ignored (or reported late) by mainstream American news outlets. Thanks!

I still see crypto currency as a Royal None-Such. I’d love to call Bitcoin a Ponzi Scheme because it currently acts like one due to those hyping it (and hodling), but the actual product doesn’t promise any returns and as such is more akin to baseball cards and Beanie Babies without the intrinsic value/intangible value that both of those collectibles offer when the market falls out. The saddest fact of Bitcoin as a private fiat script is that it doesn’t even have a company store or anything backing its value. Other crypto currencies have created for themselves a required use function with certain services/product that might give them an intrinsic value (or use) to those who need their services/products, but this has yet to really manifest itself in the real world as something of value. So be careful when buying, someone’s going to end up holding the bag at the end of it.

If anyone is interested, watch American Pickers (on History Channel). Mike Wolf, one of the pickers is a fanatic on pre-1920 motorcycles also on old Harley’s and Indians. You can get a good feel for the value of what you may be looking at. You need to know enough to know whether what you are looking at, even the parts, is original or some hybrid of what it is portrayed to be.

Key to this is either knowing what you are looking at or having someone available who can give you good answers to your questions.

Since we’ve seen articles about different forms of collectibles, note that there is a fairly well-organized market for petroleum-related collectibles. These include old signs, gas and water cans, and especially gas pumps. As always, you must research exhaustively before investing.