Email a copy of 'Economics & Investing For Preppers' to a friend

8 Comments

- Ad SOURCE FOR IVERMECTIN / HCQ, ANTIBIOTICS, ALL REGULAR MEDS“Mygenericstore” is a well-established pharmacy service that deals primarily with generic medicines produced by quality-assured manufacturers from developing countries.

- Ad Survival RealtyFind your secure and sustainable home. The leading marketplace for rural, remote, and off-grid properties worldwide. Affordable ads. No commissions are charged!

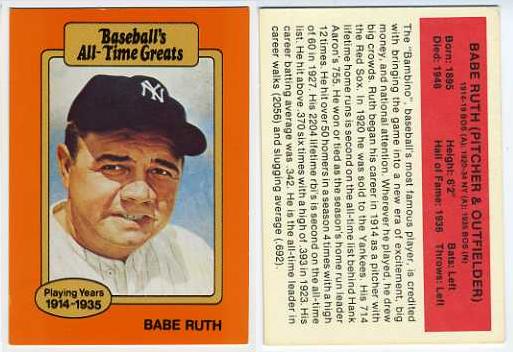

Baseball cards? Hardly what I’d consider ‘tangibles’. Guns, ammunition, tools, food, meds would retain value in a societal crash because people need them. Gold and silver coins are easily recognized and are waterproof. Even fire won’t destroy them. If you must buy collectibles, why not something with utility like antique furniture? Prices are way down. I enjoy baseball, but I wouldn’t bet the farm on baseball cards.

Depends on the level of collapse. Certain cards and coins are rare and garner constant attention among collectors. They will hold value after a recovery begins. Cards aren’t for me either but demand isn’t eliminated for all classes of high demand collectibles – it’s interrupted.

‘Depends on what constitutes the “disaster.” We prep for TEOTWAWKI. We also prep for the loss of a job, health issues, and the like. If I were in a financial pinch, I’d rather sell off a prized trading card than, say, my pickup truck.

That being said, I have NO IDEA what makes people pay so much for a scrap of cardboard that, when originally sold, went for about a nickel, and came with four or five other cards and a stick of gum!

I like the points you’ve been covering on hard assets investing. I’ve been focusing on Garands from WWII and the Korean era. Prices are stable as they are still being disbursed via the CMP program. They’re also fully functional rifles that can be very accurate and built to handle abuse.

Perhaps more than anything else, failure to recognize the precariousness and fickleness of confidence — especially in cases in which large short-term debts need to be rolled over continuously — is the key factor that gives rise to the “this-time-is-different” syndrome. Highly indebted governments, banks, or corporations can seem to be merrily rolling along for an extended period, when “BANG!” –confidence collapses, lenders disappear, and a crisis hits. — Carmen Reinhart and Kenneth Rogoff

The Nomi Prins article is intriging and troubling.

For those interested in baseball cards (investment or just collecting for a hobby), net54baseball.com is one of the best online sites for learning and buying/selling/trading. The site focuses on vintage cards, especially pre-WWII.

Cards,stamps etc maybe a good way to transfer wealth out in case of capital controls in a GOOD situation