Email a copy of 'Guest Post: In A Better World, by Gary Christenson' to a friend

6 Comments

- Ad Civil Defense ManualThe Civil Defense Manual... The A to Z of Survival. Look what in it... https://civildefensemanual.com/whats-in-the-civil-defense-manual/

- Ad SIEGE Belts & Stoves — the most essential & effective accessory one can carry anywhere. Often gifted to prepare adult sons, daughters & in-laws. Stunning new buckle options! Lifetime warranty. Saves on belt replacements.Get ready for the outdoors with the performance Siege Stove. Fastest boil of 10 stoves in Firearms News. Ultra-versatile & packs flat. Family business dedicated to USA Made.

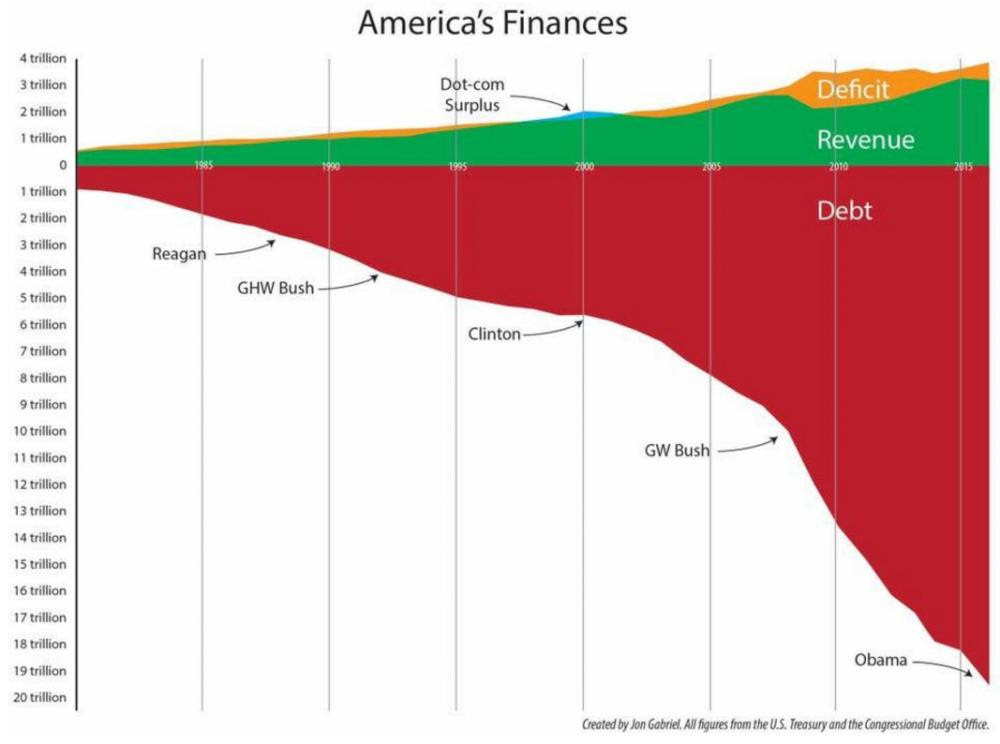

My thanks to Mr. Christenson for one of the most concise tutorials I’ve ever seen on the disintegration of the fiat money system. The graphic illustrations are clear and disturbing. Thank you!

The only thing I would add or change is in the first graph the “DOT com surplus should be called the Newt Gingrich surplus. He was very effective in balancing the budget and then holding Clinton’s spending down to keep it balanced. I suspect it is referred to as the dot.com surplus only to deny Gingrich the credit.

This is one of the more common reasons to prepare for bad times ahead.

Gold and silver are money but only if you can sell it to someone willing to accept it.

Try paying for a car or even one gallon of gas with them.

Sadly even though gold

And silver are money they are controlled by the same governments that debase the fiat currencies.

And if gold hits $5000 you can bet the government will get their “cut”.

And there is nothing you can do about it.

Gold probably won’t reach $5000 (in today’s PPP) as between $3000 and $5000 mining gold from seawater becomes economical. There is for all practical purposes infinite amount of gold in the seawater, so gold has its price ceiling only inflation can lift.

As the “price” of gold, in any of the various currencies rises, do you expect the cost of seawater mining to remain constant in terms of those same currencies?