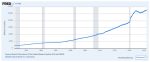

In Economics & Investing Media of the Week we feature photos, charts, graphs, maps, video links, and news items of interest to preppers. This week, a FRED graph showing the M2 Money Supply, provided by the St. Louis Federal Reserve. JWR’s Comment: With such a dramatic expansion in the number of U.S. Dollars in circulation, there is no doubt why inflation is so pernicious, and why commodities are enjoying secular bull markets.

The thumbnail below is click-expandable.

Economics & Investing Links of Interest

- Silver was shining brightly again this week, as the Silver Shorts have nearly surrendered, following the Black Friday Comex trading outage debacle. Spot silver briefly hit $58.03 USD per Troy ounce in Asian trading on Monday morning (December 1, 2026.) By Tuesday afternoon, spot silver on the Comex was up to $58.83. That was another all-time intraday high, for silver. This brought the silver-to-gold price ratio [2] below 72-to-1. Wednesday morning on the Comex: $59.15. On Thursday, there was some predictable profit-taking. But September’s $41 per ounce silver now seems like ancient history. The demand for taking physical delivery of silver in settlement from the futures markets (Comex, LBMA, and Singapore) has been huge. And given the law of supply and demand… The physical supply of silver in the West is fully depleted. So, I fully expect to see $70/oz. spot silver in the next few weeks. And if silver survives some expected greatly increased margin requirements on the Comex futures market, there is a possibility of a full-blown breakout to above $100 USD per Troy ounce. – JWR

- Reader Tom H. sent this: Goldman Sachs polled institutional investors on gold, and found many expect it to hit $5K next year [3].

- CME Trading Is Restored to Wrap Up Week After Hours-Long Outage [4]. JWR’s Comments: They blamed it on a “server cooling” problem. But in reality, the problems were Dollar weakness and some hot Asian demand for physical silver.

- Social Security’s day of reckoning is nearly here [5].

- At Engelberg Ideas: A crash is coming [6].

Economics & Investing Media Tips:

Please send your economics and investing links to JWR [7]. (Either via e-mail or via our Contact form [8].) Thanks!