The war in Ukraine brings multiple negative consequences, not only to the world economy. Russia’s invasion also has a wide impact on the gold market.

The Consequences Are Vast

The war in Ukraine has been ongoing for more than three months. After the withdrawal from the north of Ukraine, Russia has focused on the east and south of the country, aiming to take full control of Donbas and to create a land corridor between it and Crimea. The consequences of a Russian invasion into Ukraine are far-reaching in many areas.

- The war is a humanitarian crisis. Thousands of people died, while millions fled the country.

- Ukraine was also severely hit economically. The GDP is forecasted to fall this year by 35% or even more on top of the vast destruction of the country’s infrastructure (the total amount of direct infrastructure damage has surpassed $100 billion), reduced labor supply, and halted investments.

- The Russian economy is projected to decline by 8.5% or even more due to the sanctions, financial crisis, and the closure of economic ties with the West, including the withdrawal of many companies from Russia.

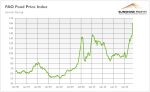

- There is a global food crisis. Russia and Ukraine are significant producers of many agricultural products. They produce 60% of the world’s sunflower oil and account for almost 30% of wheat exports. Ukraine is also a leading exporter of corn, barley, and rye, but because of the war, many crop areas won’t be planted or harvested. What’s more, both Ukraine and Russia are also major producers of fertilizers. Additionally, because of the naval blockade, Ukraine’s ability to export its commodities is severely limited. The rise in food (and fuel) prices (see the chart below) could aggravate the food insecurity in some parts of the world, increasing the risk of unrest.

- There is a global energy crisis as well, as Russia is the second-largest producer of natural gas and the third-largest producer of oil. The EU is particularly severely hit as it is most dependent on Russian energy.

- The rise in food and energy prices is adding to the inflationary pressure and is hampering GDP growth. The war is a negative supply shock which is stagflationary in nature. The IMF [2] has already cut [3] its forecast for global growth this year from 4.4% to 3.6%, mainly because of the Russian invasion.

- The war will also have important long-term geopolitical consequences. The Russian invasion reenergized NATO, prompted Finland and traditionally neutral Sweden to apply for membership in this military alliance, and triggered an increase in military spending across all of Europe, including pacifist Germany.

- Moreover, Russia’s position will weaken, as its failure – despite the huge military advantage – to defeat Ukraine shows that, in reality, it’s a less powerful country than people feared. The huge military losses in terms of soldiers and equipment will weaken Russia’s military strength for years. What’s more, Europe is reducing dependence on Russian hydrocarbons, the major country’s leverage. Russia is effectively cut off from Western economic integration and will probably be driven into a closer and more subservient relationship with China.

How Will This Affect Gold?

Okay, but what does it all mean for the global economy and the gold market? Well, we are experiencing higher inflation [4] and slower economic growth, so we are moving closer to stagflation [5], which should support gold prices. The Russian invasion is also another blow to globalization and global supply chains, which increases the odds of permanent fragmentation of the world economy into geopolitical blocks, as known from the Cold War. Such changes in the global order would be negative for productivity, also leading to slower growth and higher prices. Compared to the pre-war reality, we live in a much less secure world. After all, there is an ongoing full-scale war on European soil. A “peace dividend” has ended, and military spending will have to go up, leading to slower growth in the standard of living. The rise in uncertainty should also increase demand for safe havens such as gold [6].

On the other hand, because inflation is projected now to remain elevated for much longer, the central banks will be under pressure to tighten their monetary policies [7] more decisively. The more aggressive Fed’s tightening cycle [8] should be negative for gold prices, at least until it triggers a grave economic slowdown or even recession [9].

What’s more, the war has more negative economic consequences for Europe, which is more dependent on Russian energy, than for the United States. Hence, the dollar should strengthen against the euro [10], negatively affecting gold prices. That’s true that the ECB [11] is expected to join the club of monetary hawks, but given the war’s impact on economic growth, Lagarde [12] can be more cautious with interest rate [13] hikes than Powell [14], which should also support the greenback [15].

– Arkadiusz Sieron, PhD

Note: This article, re-posted with permission, was first posted by Sunshine Profits [16]. They publish a free gold newsletter [17].