Here are a few reasons why gold should be accumulated at these levels:

1. Rising Interest Rates

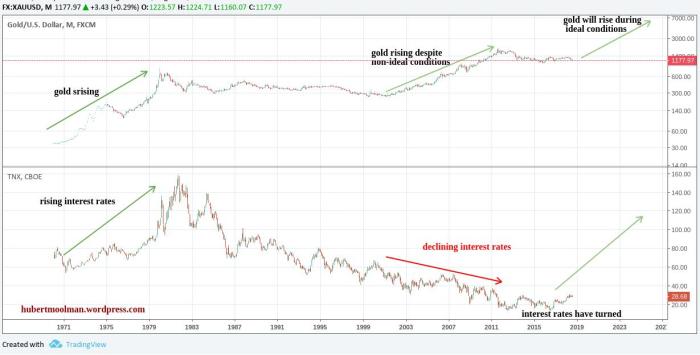

Although gold rose significantly from 2001 to 2011, it was not really the ideal conditions. There were many reasons for conditions not being ideal, such as: rising stock markets and major commodities like oil (more markets rising means more competition for investment).

However, now I would like to focus on only interest rates. The direction of interest rates is normally indicative of a type of economic condition that exist. During the period from 2001 to 2011 interest rates were falling, and this was indicative of economic conditions that are less than ideal for gold prices.

In fact, these falling interest rates were in some way facilitating significant rises in the stock market and oil for example, which are investment classes competing with gold.

Interest rates turned in 2016, and this indicates conditions that will be ideal for gold is forming. Interest rates are an indication of the value the market place on debt. If interest rates are declining then a higher value is placed on debt.

If interest rates are rising, then a lower value is placed on debt. Gold and debt are basically completely opposite asset types. So, when interest rates are falling then a lower value is place on gold and vice versa.

Below, is a chart that compares gold prices to interest rates: [1]

[1]

The 70s gold rally occurred during ideal conditions – when interest rates were generally rising. However the gold rally from 2001 to 2011 occurred during falling interest rates, which is less than ideal.

With the coming rising interest rates, gold will rise much more and much faster than it did during the 2001 to 2011 bull market phase. It will rise until interest rates are at relatively high values, so that debt is valued very low.

2. The relationship between gold and the South African Rand/US Dollar (USD/ZAR) exchange rate

This is more of a technical reason. Below, is a long-term USD/ZAR chart:

I have highlighted three significant peaks of the USD/ZAR chart. These were formed roughly seven years apart. This ratio tends to spike significantly before major market events or turnarounds.

After each of the first two significant peaks (2001 and 2008), a multi-year gold rally followed. Currently, gold prices hare higher than the level it was at the last USD/ZAR peak, but it has not really taken of yet. The probability that it will accelerate higher over the coming months and years are really high.

Furthermore, it appears that another spike is currently forming on the USD/ZAR chart. This indicates that we will likely have a gold rally in the short-term. It also is possibly signaling a change in acceleration of gold rising, as measured from the last USD/ZAR spike (of January 2016).

For more on this and this kind of fractal analysis, you are welcome to subscribe to my premium service [3].

This post first appeared on Hubert Moolman on Silver and Gold [4]

Comments Disabled To "Guest Post: Why Gold Should Be Accumulated At These Levels"

#1 Comment By DL On August 22, 2018 @ 12:27 pm

Consider buying gold mining stocks, especially junior miners. They rise far faster than just the bullion price.

#2 Comment By Old John On August 22, 2018 @ 3:10 pm

About when to buy Gold

If you are thinking about buying the most important question is why. There are different answers and they do matter! Some want to be “Precious Metal Investors” others want a little “Insurance”.

I have been collecting, buying, and selling gold and silver for about 50 years now. I am not an expert but I have noticed some things over the years. One is: most often an article advising us to buy gold or silver is written by someone in the business of selling gold and silver. They are not always wrong, but the advice is always the same, BUY NOW. I can’t remember them advising us to wait till the price drops a little lower. I don’t know if this article is one of those – maybe?

Regardless, as an investor in big amounts there are a lot of things that can be analyzed and almost as many interpretations of the data. In the end the goal is to buy low & sell high! That creates a dilemma for someone that wants insurance. If you have bought a few hundred or a few thousand dollars worth to insure against a stock market crash, rampant inflation, an economic collapse, or an extended grid failure do you really want to sell when the price doubles? Does that skyrocketing price suggest trouble is here or soon will be? By selling are you canceling your insurance policy just when you are going to need it most? I believe there is some amount of gold or silver that everyone should have and never intend to sell at any price – unless it is a matter of life and death. If you never need it someone you love can inherit it from you. Mean wile you will have had years with a feeling of more security. For that type of buyer the price ups & downs don’t matter so much. The time to buy it is when you can afford it.

For big investors you should be getting your financial advice somewhere else! That said consider this: the purchasing power of the dollar is increasing as the price of gold is decreasing. At some point, maybe very soon, the price of gold will be at a low and the purchasing power of the dollar will be just about to go down. I believe that would be a great time to buy; figure out when that is, do it, and you will be considered a genius! I am waiting a little while yet for my genius moment – don’t know how long at this point.

#3 Comment By Sean On August 22, 2018 @ 5:54 pm

One of the first pieces of advice I ever took from JWR is to get into physical gold and silver, in the smallest denominations, and I also took his advice on “junk” physical silver. While I’m not finished “collecting” yet, I’ve been blessed to put together a respectable collection. The idea that I have something that amounts to real currency is rather comforting, especially since I don’t have any respect for paper dollars, backed by nothing. Since it is all in my hands, I can transfer on death, or life, when I want to, without govt. interference or tax, to my heirs, or whoever. I liked JWR’s view that junk silver in US denominations is more recognizable and easily moved in and out of US markets, and will probably be used in down times. Currently, my silver and gold is worth less than what I paid for it, but I’m not worried in the least as to its value. Knowing the national debt and other huge negatives, the real value of gold and silver is depressed by those who use debt as an asset.

#4 Comment By Skip On August 22, 2018 @ 9:01 pm

A gold trade 2 days ago. I sold

X-amount of Maples for a project I am working on.

I went to my local coin shop that operates in 2 cities, one of which is Portland, Ore.

The number of coins was less than ten and he did not have either cash or could write a check for the balance.

This was not a problem for me at the time, but markets are all up. The economy just passed the longest bull run ever. People are spending money on extras not just survival.

Anyway, where will one sell in an emergency? Will you get market value. My point is gold like anything else needs a 3rd party to achieve a good trade.

My friend while in Idaho asked two separate businesses if they would trade is 10 ounce silver bar for a tank of gas. The answer was no. They had no idea what is was worth. At that time is was over $200 US dollar [for a 10 Troy ounce bar].

Gold is not the hedge people think it is and are being giving a false sense of security.

#5 Comment By OneGuy On August 23, 2018 @ 1:17 am

It depends. I remember when silver was $50 an ounce(1978 I think). Every coin shop was buying. Long lines outside and they bought all the silver they could get their hands on. So the answer is it depends on what the crisis is and what the buyers think the future is.

#6 Comment By Old John On August 22, 2018 @ 10:26 pm

Skip, I think under those circumstances I would have kept my gasoline even if I knew the spot price of silver. With no scales or acid for a test the silver could be counterfeit. Not only that if your friend was a stranger willing to trade $200 of silver for a tank of gas in normal times I would think the silver was stolen, so no – NO SALE. However in times when the currency was getting so devalued that few people want to take it (hyper inflation, currency collapse, real political or social turmoil) and we were approaching a barter economy it would be different. Then I would have my test kit and I would be much more likely make the trade, even though I might rather trade for a big bag of rice!.

#7 Comment By Deplorable Silver Stacker On August 23, 2018 @ 1:49 pm

This is why I buy one oz silver rounds, easier to buy/sell/trade than larger multi-ounce bars.

#8 Comment By Skip On August 23, 2018 @ 3:44 pm

My comments about my friend is this test was done in Idaho where he has had rental business for years.

It’s in the heart of Redoubt and on two separate occasions the locals did not even have a clue it’s was silver bar.

Lastly, the point of buying rice or food in general will be priority number one, the gold will be sitting in ones safe.

#9 Comment By Kroneborge On September 6, 2018 @ 11:50 pm

Disagree. When interest rates rise it increases the opportunity cost to own gold. For example, right now leaving money in the bank or CD gets little to know interest, so owning gold has little opportunity cost (the forgone interest). But when interest rates are higher, you are giving up more interest by holding gold.

#10 Comment By Kroneborge On September 6, 2018 @ 11:52 pm

Oh and the 70’s bull market was from rising inflation NOT rising interest rates (so really what you want to look at is the real interest rate).